Company, Investments

What You Need to Know About Qualified Opportunity Zones

January 28, 2020 - Company, Investments

by: John Kohnstamm, SIOR & Art Karas, Capacity Commercial Group

At the end of 2019, the IRS released the Final Regulations for Qualified Opportunity Zones (QOZ). We’ve highlighted what a QOZ is, how to invest in it, the tax benefits it provides, and how the final regulations relate to real estate investors.

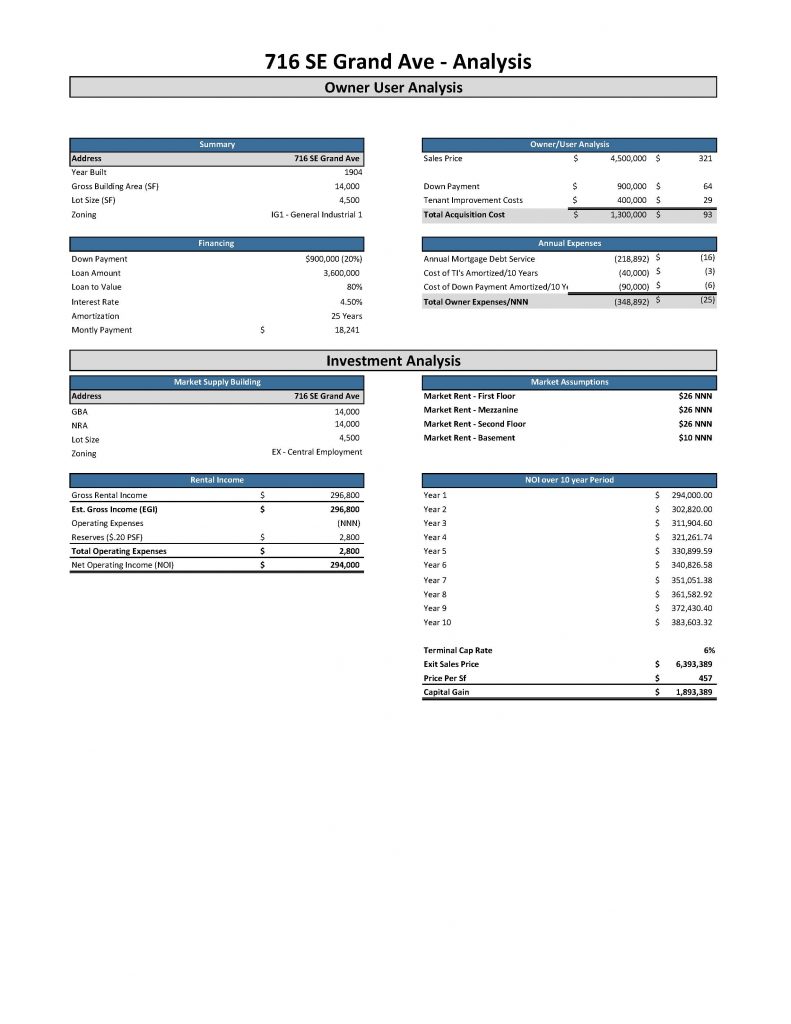

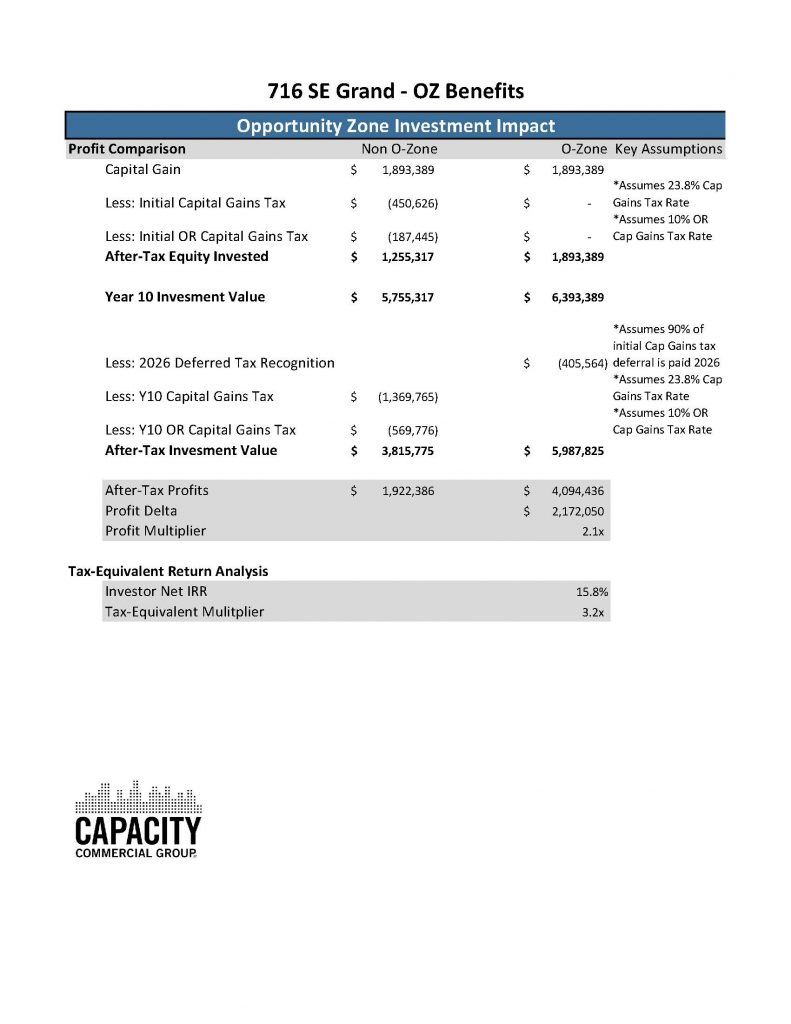

We’ve also included a real time example of the benefits of a QOZ property as an investment.

What is a Qualified Opportunity Zone?

Opportunity Zones originated from the 2017 Tax Cuts and Jobs Act with a goal to spur on economic activity in low-income areas through preferential tax treatment.

How does one invest in a Qualified Opportunity Zone?

The best way to invest in a QOZ is through an Opportunity Fund.

What are the tax benefits of investing in a Qualified Opportunity Zone?

– Temporary deferral of capital gains reinvested in an Opportunity Fund

– A step up in basis: After 5 years, investors receive a 10% step up witt an additional 5% after 7 years. Total step up after 7 years would be 15%.

– A permanent exclusion of capital gains from the sale of an investment in an Opportunity Fund if the asset is held for at least 10 years

How do the regulations impact real estate investors?

Single triple net assets will not qualify as an eligible trade or business. However, a portfolio of triple net leases or combination of triple net and non-triple net leases will likely qualify.

Additionally, the regulations now allow for aggregate assets for purposes of the substantial improvement requirement if on the same QOZ or a continguous QOZ.

Real Time Example: 716 SE Grand Boulevard

What this analysis of benefits on the QOZ tax treatment shows is that based on rents, exit cap rates and financing, the tax-equivalent profit multiple on invested capital is 3.2 times. In other words, the QOZ benefits are equivalent to earning 3.2 times your invested capital if you had to pay taxes on the gain.

*To download this analysis as a PDF, click here.

For more information, please contact:

John Kohnstamm, SIOR: john@capacitycommercial.com (503.542.4355)

Art Karas: art@capacitycommercial.com (503.517.9879)

Click here to download team information